Alright, many people are asking me if the tutorial I made last year about Tax Refunds is still the same as the current one? The answer is straightforward, Yes !. The only difference is that you can't put any random figures because IRS will check all your tax figures before you get paid.

Please, I encourage you to follow the step-by-step method I share. I won't be using screenshots this around due to some security reasons. But I want to make this tutorial very simple and understandable. Initially, I did not want to post this tutorial because last year, many reports confirmed many people's identities were stolen for these Tax Returns. Based on that, the IRS cross-checks the figures you enter plus the ones they have on their database, making it difficult to pass through. Below is the information sent to the FBI

Investigators started targeting people involved in the BEC scam in May 2019 and discovered that "the conspirators stole more than 250,000 identities and filed more than 10,000 fraudulent tax returns, attempting to receive more than $91 million in refunds," according to Chief Don Fort of IRS Criminal Investigation.

BEC Now A $26 Billion Online Fraud

According to the FBI's Internet Crime Complaint Center (IC3), between June 2016 and July 2019, there were over 166,000 domestic and international reports of email scams resulting in more than $26 billion in losses, up from a previous estimate of $12 billion.

In 2018 alone, nearly $1.3 billion, which is almost twice as much as 2017, in loses was reported from BEC scams and its variant, Email Account Compromise.

"Through Operation rewired, we're sending a clear message to the criminals who orchestrate these BEC schemes: We'll keep coming after you, no matter where you are," said FBI Director Christopher A. Wray.

"And to the public, we'll keep doing whatever we can to protect you. Reporting incidents of BEC and other internet-enabled crimes to the IC3 brings us one step closer to the perpetrators. "Several US authorities led this operation, including the FBI, over two dozen US Attorney's Offices, US Secret Service, Homeland Security Investigations, IRS Criminal Investigation, US Postal Inspection Service, and US Department of State's Diplomatic Security Service.

That's just by the way; I'm going to walk through how to file these Tax Refunds because there are some calculations we need to do when filing for Tax Refunds, so let's get started.

NOTE: The Below information is only for educational purposes; I may not be responsible for any damage cost.

How To File For TurboTax Refunds 2022

Requirement

- RDP OR 911 vpn

- DOB as shown on the SSN

- SSN

- Complete address on SSN

- Full name on SSN

- Background checker

- Text Now or Google Voice number

- Create a separate email

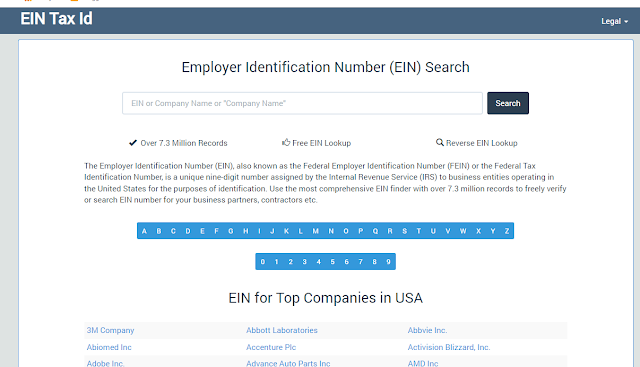

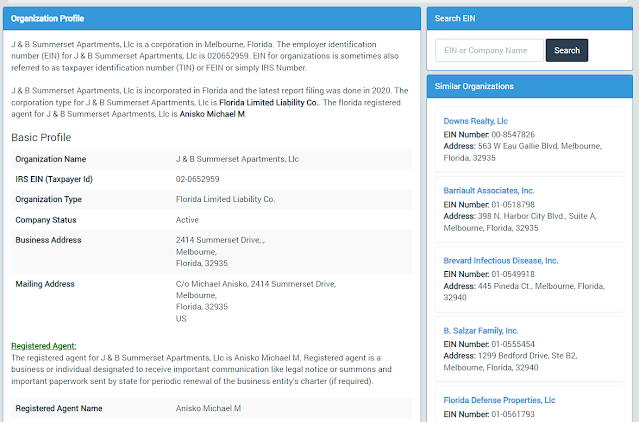

4. The EIN of the company and other details should pop up

Since we now have the EIN number we are looking for, let's check the company assets.

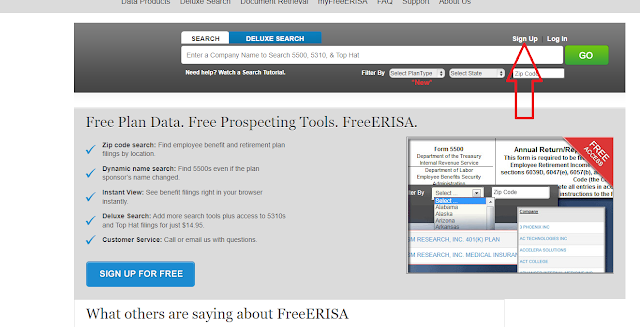

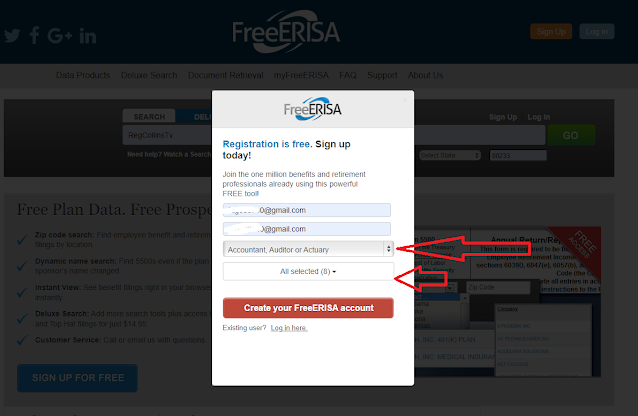

5. Now browse the Benefits Pro website by clicking on freeerisa.com

7. After clicking on signup, A new page will pop up, Enter the separate email you created, then choose the rest of the information like in the screenshot

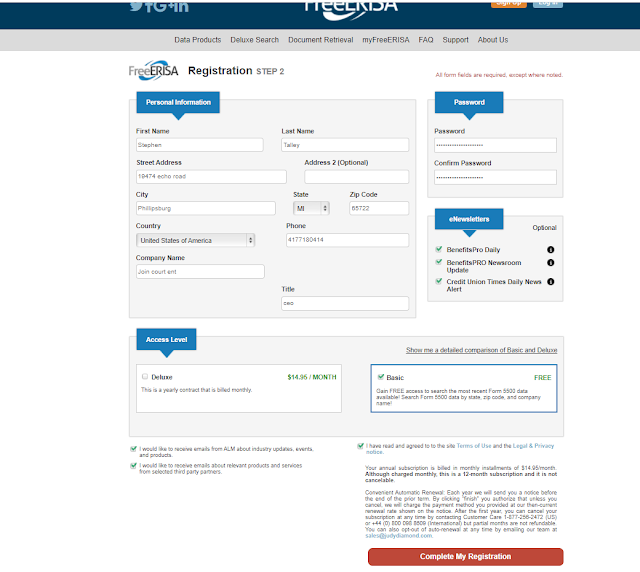

8. Now, enter any information here. You can use dead fullz details here, but your email must be correct because they will send information there.

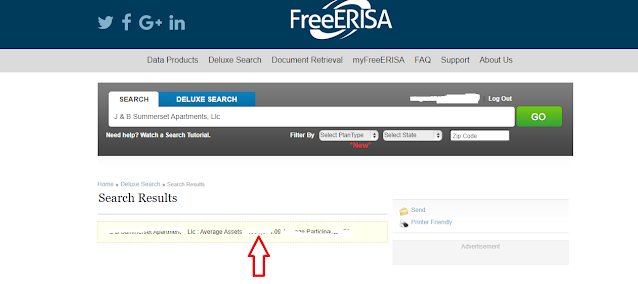

9. After creating and verifying the account, Enter the company name you got from eintaxid.com in step 4 in the search bar. Make sure to enter the zip and state as it appeared on eintaxid.com

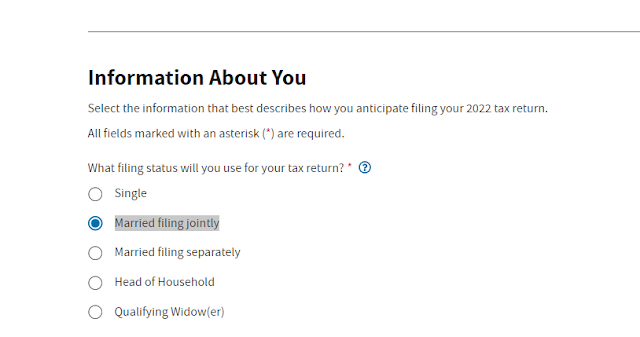

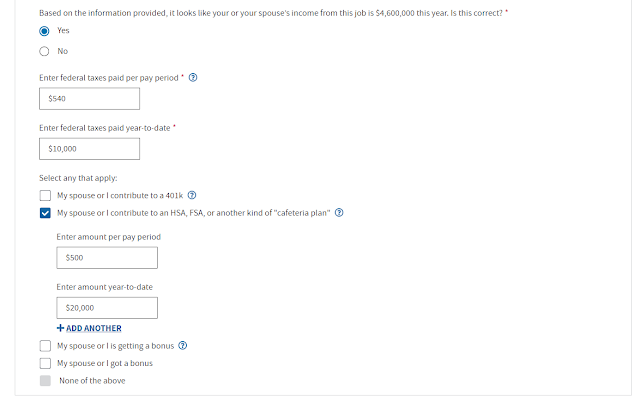

13. Do you (or will you) or your spouse have a job that regularly withholds federal income taxes from your paychecks? Check the YES box.

Hey bro can i get your channel link??

ReplyDeleteThis thing u Dey post am free have you thought of when u start Dey go broke how you go survive

ReplyDeleteNa ur papa want make am broke ?

Deleteu be foolish boi paaa u only u won chop

Deletecan I use this same method for cash app tax

ReplyDeleteBoss the link on Tax refund page that we need to download to get the complete tut, is not working, pls try and see first.

ReplyDelete