Illinois state is giving out loans to support Small Businesses Source to continue their recovery and resiliency from the pandemic. This loan is only paid to Illinois citizens operating a small businesses.

Any qualified person can get up to $10,000. It is advisable to take note of the below information before applying for this loan. The person filling out this grant application is either

- The owner of the business,

- A key decision-maker for the business

- All information provided in this application should be true and accurate to the best of your knowledge.

Before you file this application, make sure your client has a small business he is managing with the below documents and accurate information on the documents :

- A valid form of photo identification

- 2019 Federal Tax Returns for your business

- W-9 Form

Those going to get fullz for this kind of Job should have in mind they need some background information on the fullz before they begin the process, or else you will do a cost 90 work. Now let get to the main process.

Required/ Tools Needed:

- SSN Number

- First and last name

- DOB

- RDP or any Good VPN

- Create an email matching your SSN details

- Google Voice Number or Text Now number from the given address below

- Bank Account or RN or AN matching the SSN.

- Front and back of Drivers License/Passport/State Identification/Military Identification

- Business 2019 Federal Tax Return (e.g., Form 1040 w/ Schedule C, Form 1065, or Form 1120)

- W-9 form

Warning: This below article is an illustration of how to apply for Illinois Grow Grant Loan Benefits. This article is only for educational purposes. I may not be responsible for any damage cost.

Steps To Apply For Illinois Grow Grant Loan Benefits

1. Connect your VPN or socks to Illinois state then move to whoer.net and check if your IP is clean

2. Go to Illinois Grow Grant Loan Benefits website by copying this link to your browser : https://bit.ly/3DIs1pQ

3. On the Illinois Grow Grant Loan Benefits website, scroll down and click on Apply Now

4. Enter fullz name in the Business Legal Name and fill out the other information

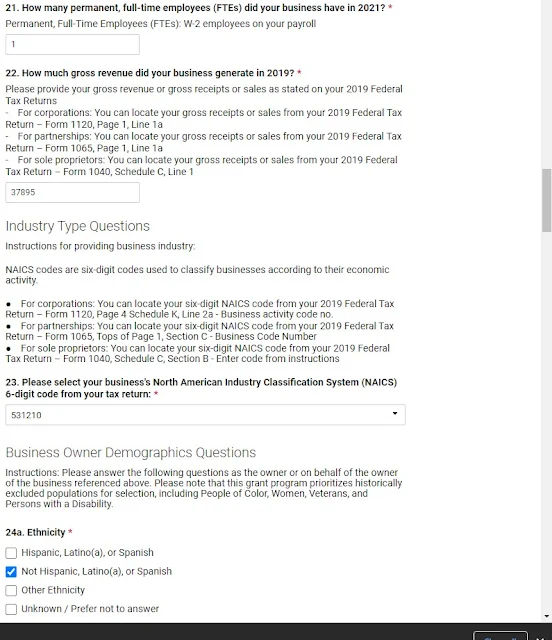

6. Now select Social Security Number and enter Illinois number ssn number and choose the related information like below

7. Make sure the details you provide here will also be found on your 2019 Federal Tax Return – Form 1040, Schedule C. ( If you already have those documents, just enter those information's)

9. You can answer like below or make some adjustment to make it look different

11. Enter the Bank Account and Routing Number (This is where the loan will paid into so make sure you have access to it

14. You can submit by clicking on the submit button

15. You will get this Success! after submitting

Conclusion:

Now wait patiently for their email response and feedback. If the information you submitted looks convincing you will get approved for payment. But have it in mind, they have not started paying. But start from 2023.