After making a tutorial on Sba and other Tax Return loan methods, most people need help editing the Forms they are provided to edit. Yes filing documents like the 1040 Form, 2019 Business Tax Return, ODA forms P-022 standard etc. can be confusing. Even those leaving in the united state may need help keeping track of the many forms and calculations required. Luckily I was able to meet IRS agents on fiverr who explain to me how to edit the 1040 Form.

Suppose you mean business and want someone to help edit forms from Tax Returns, Florida rental assistance or SBA. In that case, I advise you to go to any freelancing website like Fiverr and get IRS agents to help you edit your document.

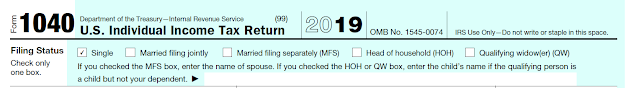

Okay, so to cut everything short, let me share what I learnt from IRS agents who assisted me in editing my 1040 Form. According to Wikipedia, Form 1040 is an IRS tax form used for personal federal income tax returns filed by United States residents.

How to edit the 1040 Form when filing Tax Return or Sba

1. Okay, so we will first need to edit by filling out your client's personal information, its status, such as single, married filing jointly, or married filing separately, and how many dependents you have

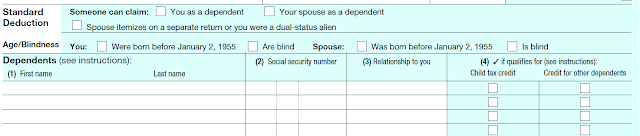

2. Now, in this section. Carefully enter the details based on the personal information you selected. If you set "single", enter only client information by editing the following:

- Your first name and middle initial

- Last name

- Social security number

- Home address (number and street)

- City

3. Standard Deduction and Age/Blindness leave these fields empty since it's not a Joint or you did not select Married filing jointly.

4. If you are filing for an independent company, add a Schedule C to your 1040. This is a two-page add-on report that rundowns every claimable cost. Self-employed entities and entrepreneurs who made more than $400 should fill out Schedule SE, which calculates self-employment taxes.

Some businesses even need to pay quarterly estimated taxes if their withholdings do not cover the taxes they owe. In this case, those companies would file 1040 ES forms.

Calculate your Adjusted Gross Income which you will report on line 8b. To find your Adjusted Gross Income, report your Gross Total Income, then subtract any allowable adjustments. These adjustments are also often referred to as above-the-line deductions. Then, the IRS will use your Adjusted Gross Income to determine how much you owe in taxes.

Note: If you don't know what Adjusted Gross Income is, Check it on the IRS website by clicking here