Are you searching for a tutorial on how to file Australia MyGov Tax Refund? Because I'll help you with all the answers you may need before you move on to the website to apply for the tax return. My readers have received many requests to write a tutorial on this subject (MyGov Tax). But due to the requirement to file this method, I turn a deaf ear to all.

Note: I do not have the necessary information to apply, so I may not use any of the screenshots in this article, but when you follow carefully and have the requirement, you can file easily.

What is Australia MyGov Tax Refund

MyGov is an online platform in Australia that allows citizens to access various government services and information in one place. One of the services available on MyGov is managing your tax affairs, including lodging your tax return and tracking your tax refund.

You may be entitled to a tax refund if you have paid too much Tax during the financial year (from July 1 to June 30). This refund can be claimed through the Australian Taxation Office (ATO) and is typically paid directly into your nominated bank account.

Using MyGov to manage your tax affairs can make tracking your refund status easier and ensure your tax return is lodged correctly and on time. You can also use MyGov to update your details, view your tax history, and access other government services.

Requirement/ Needed Tools

To file a MyGov Tax return, you must create an account on my.gov.au and link to the ATO. Linking your account to Ato helps manage and shape your tax and superannuation systems to support and fund services for your Return.

- So all you need is to get a MyGove account linked to ATO

- Good VPN to connect to Australia

How To File Australia MyGov Tax Refund

With your MyGove account linked to ATO logins ready

1. Connect your IP to Australia and check if your Anonymity is on whoer.net

2. Go to the MyGov website by clicking here my.gov.au.

3. Click on the login

4. Enter the details you took from your friend or client in Australia.

5. You will need to enter a code or answers. (The account owner should provide it).

6. On your dashboard, click on Australian Taxation Office. (If the account is not linked to ATO, you will not see this option).

7. In your account navigation bar, click on Tax.

8. Then click on Lodgetment, and click on Income Tax.

9. On the next step, click on History.

10. Click on click here if you need to lodge.

11. You will see the residential address of the account. Click on Next

12. Now, enter the bank details you want to use to receive the money and click on Next.

13. If they ask, Were you an Australian resident for tax purposes from July 2020 to June 30, 2021? Choose No

14. Did you have a spouse between July 1, 2020, and June 30, 2021? Choose No

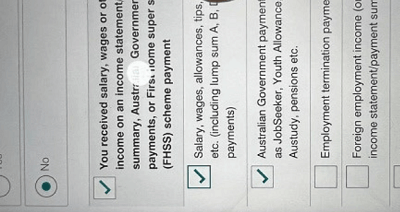

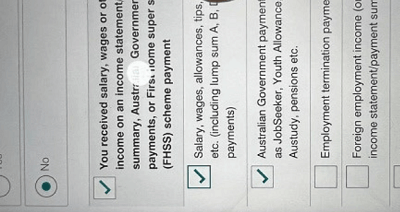

15. Check the box for the first three questions about Salaries, Youth allowance, and FHSS.

Same as the interest

%20(1).png)

16. Check the box for "You had Australian interest or other Australian income or losses from investments or Property" and Interest

17. Check the boxes for all the below questions

18. Check the box for "You are claiming tax offsets, adjustments, or a credit for early payment" and Credit for interest on Tax paid

19. It will direct to your summary page, where all Tax withheld will be shown; let's move to the next section.

20. Enter the bank account you will receive the tax return money

21. If they ask you several different children and students, type 0

22. Medicare levy exemption, choose No

23. Choose Yes before the Medicare levy

24. The below shows the owner's private insurance and membership number. Click on Open profile

25. You will see the rebate received from the account; delete the client's own

26. You see, Private health insurance policies. Click on the Add button.

27. You will receive the Health BUP, Membership Id, and other information. Scroll down and click on save.

28. When you reach this section, click save and continue.

29. Select the answer like you see in the below screenshot

30. Click on the calculate button. You will see your estimated refund you will get

31. When you are directed to this page, file everything till you don't see click here again

32. If you follow everything correctly, you should get paid unless you mess up the account or did not fill it well.

Conclusion

You can leave your feedback in the comment section. Take note: I need to learn how to spam an ATO account; it will be better if you follow the guide as instructed.

.png)

.png)

.png)

.png)

.png)

.png)

%20(1).png)

%20(2).png)

.png)

.png)

.png)

.png)

.png)

Brother please for the sake of God .... How do we spam Ato?

ReplyDelete🙏🙏🙏🙏🙏

Delete