Do you have a client in Minnesota who owns a homeowner or renter who wants to save money on your property taxes? If so, he may be eligible for a property tax refund from the state. The property tax refund program provides tax relief to low- and moderate-income households based on their income and property taxes or rent paid. In this article, I will show you how to apply for a property tax refund, the eligibility requirements, and how much you can expect to return. Let’s get started!

What is the property tax refund?

The property tax refund is a refundable credit you can claim on your Minnesota income tax return if you meet specific criteria. The refund is based on a percentage of your property taxes or rent paid on your primary residence in Minnesota. There are two types of property tax refunds: the regular property tax refund and the special property tax refund.

The regular property tax refund

The regular property tax refund is available for homeowners and renters with household income below a specific limit. The income limit varies depending on your filing status, the number of dependents, and whether you are a homeowner or a renter. For 2022, the income limit ranges from $69,520 to $128,280. You can find the exact income limit for your situation on the.

The regular property tax refund amount depends on your household income and property taxes or rent paid. The refund is a percentage of the difference between your property taxes or rent paid and a portion of your household income. The rate of refundable property taxes or rent paid decreases as your income increases. The maximum refund amount for 2022 is $2,440 for renters and $3,140 for homeowners. You can use them to estimate your refund amount.

The Special property tax refund

The unique property tax refund is available only for homeowners with a net property tax increase of more than 12% and at least $100 from one year to the next on the same property. The net property tax increase is the difference between your property taxes payable in the current year and the prior year after subtracting any refunds you received or expect to receive.

This type of tax refund is not based on your income; the special property tax refund is 60% of your net property tax increase exceeding 12%. For example, if your property taxes increased by $500 from $4,000 to $4,500, your net property tax increase is 12.5%, which is $500. The amount of your net property tax increase that exceeds 12% is $20 ($500 - $480). Your special property tax refund is 60% of $20, which is $12.

Why should you convince your client to apply for a property tax refund?

It is a great way to reduce your tax burden and increase your disposable income. The refund can help you pay for your living expenses, save for your future goals, or invest in your home. The refund is also a form of social justice, as it helps low- and moderate-income households afford their housing costs and reduces the inequality in the tax system.

According to the Minnesota Department of Revenue, over 877,000 Minnesotans filed for 2021 property tax refunds, with over $827 million in refunds issued. The average refund is about $1,100 for homeowners and $730 for renters. However, many eligible Minnesotans may need to be made aware of the property tax refund program or need more information or assistance to file for it. If you are one of them, you may miss out on a valuable opportunity to get back money from the state.

How to Apply for the Minnesota Property Tax Refund

Before you begin filing for your Minnesota Property Tax Refund, ensure you have the below information gathered:

- Name

- Address

- City

- ZipCode

- A Computer or Mobile Phone

- Good VPN

- Create an Email with the first and last name of the fullz

- SSN

- Property ID

- Direct Deposit bank details matching fullz name

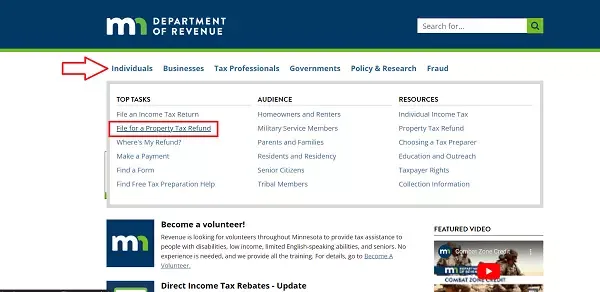

3. Expand the Online (Homeowners Only) and click on "Property Tax Refund Online filing system."

.png)