From February to October, many countries, especially the United States, have opened their portal for citizens to file their tax returns. You will recall I have posted some of the various portal tutorials, from Turbo Tax to Taxslayer; in this article, you will learn how to get an H&R Block Tax Refund for your disabled client, so without being said, let's get started.

What is H&R Block

H&R Block is a tax preparation service that works USA, Canada, and Australia. Regarding tax refunds, H&R Block assists taxpayers in preparing and filing their tax returns accurately to ensure they receive any eligible refunds owed to them by the government.

What is Tax Refund

A tax refund is a reimbursement from the government to taxpayers who have paid more taxes during the year than they owe. This typically occurs when the amount of tax withheld from an individual's paycheck or other income sources is more than the tax liability they owe based on their total income, deductions, and credits.

Information Needed To Tax Refund on H&R Block

- SSN

- Name

- DOB

- Address information. (Details should match the information on the I.D.)

- Sock5 or any Good VPN (PIA recommend)

- Create an email with the SSN details.

- Form 1099 (This form is given to USA citizens every year)

- Phone number

- Bank Routing and Account Number

H&R Block Tax Refund Method For Disabled Client

1. Connect your IP to the drop address and check your anonymous status on whoer.net

29. When you see "some of your benefits are taxable sh*t," click on No

32. Click on Start for Income profile

33. Since we are filing for a disabled person, you can enter any work a disabled person can do. Don't enter any forex trading or cryptocurrency sh*t.

34. Did you receive, sell, exchange, or display cryptocurrency? Answer No.

36. You will standard deduct is best for you; click on Next.

37. Did everyone in your household have health insurance and choose None.

38. Click on Remove my state(L.A.) return

39. Click on No Thanks

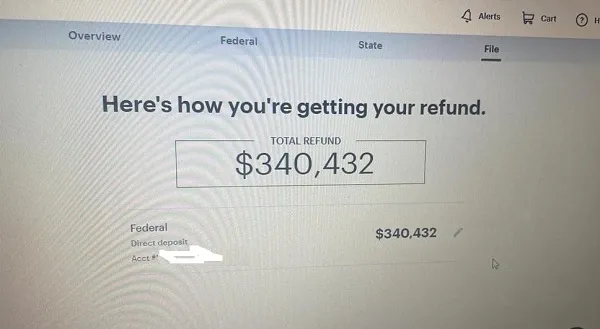

40. Enter your Bank Routing and Account Number

41. Don't choose anything; scroll to click on Next

42. Click on Continue with Free

43. Click on Remove

44. Did you file a return last year? No

45. Did IRS issue a pin? Choose No

46. You will be asked to write 5 digits, type it, and save it somewhere safe.

47. Enter a number to proceed

48. Click on Next.

49. Enter pal Dl or I.D. number and submit

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.png)

.webp)

.webp)

.webp)

.webp)

.webp)

.jpg)

@regcollins

ReplyDeletePlease at the social security withheld should we use the same figure as yours?

I got the 1099 form but state withheld is EXEMPT

Plus can we still check refund status on IRS after all the process, or how long does it takes to HIT?

ReplyDeleteYes you can check via the IRS to know your filing status

DeleteBoss I file it and a letter was send to the cl that a certain form should be submitted within 20 days of the letter

DeleteW-2, Wage and Tax Statement

Form W-2G, Certain Gambling Winnings

Form 1099-R, Distributions from Pensions, Annuities, Retirement

or Profit Sharing Plans,

It very worrisome boss I need clarification I follow the tut step by step please

Please at the social security withheld should we use the same figure as in the tutorials?

ReplyDeleteEverything should be the same unless you want decrease amount like I suggested

Deleteplease is this only going to work for a disabled cl ?

ReplyDeleteYes but if cl has never filed tax before too you can file for him

Delete