The New Jersey Income Taxes and NJ State Tax have opened or extended their portal until April next year, along with an IRS or Federal Income Tax Return, of which I have compiled the steps you can use to apply on their portal.

Before I start with a guide on how to file these Income Taxes for the residents of New Jersey, we will need some required information and documents. This information is:

Required/ Tools Needed:

- New Jersey SSN Number

- First and last name

- Date Of Birth

- New Jersey Address.

- Drivers License Number/ Passport/State Identification/Military Identification

- Socks or any Good VPN

- Create an email matching your SSN details

- Background Checks/Reports (Truth finder, instant checkmate, whitepages, etc.)

- Bank Account with routing and account number.

- 1040 Form Document (How to edit the 1040 Form)

- Google voice/TextNow or any good void number

Complete Guide To File For New Jersey Income Tax Return

Ones you have all the required information needed, You need to step up your RDP, Socks or VPN to a New Jersey or a closer state to NJ.

1. Connect your Socks or VPN to a New Jersey or a closer state to NJ and check your IP address on whoer.net to confirm if the IP is clean.

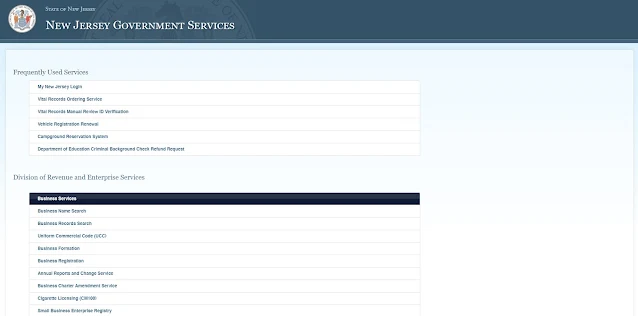

2. Then go to the New Jersey Income Tax Return website by copying and pasting this link to your browser: https://www.njportal.com/

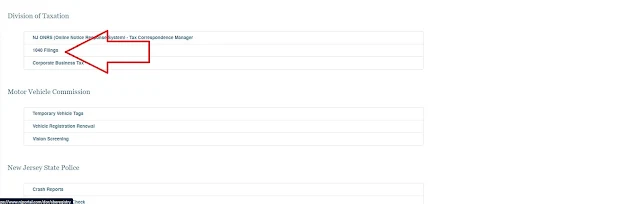

3.Locate the Division of Taxation and click on 1040 Filings

4. Then click on 2021 to start a new process

5. Under relationship status, you can choose any of the answers and click on Save and Continue

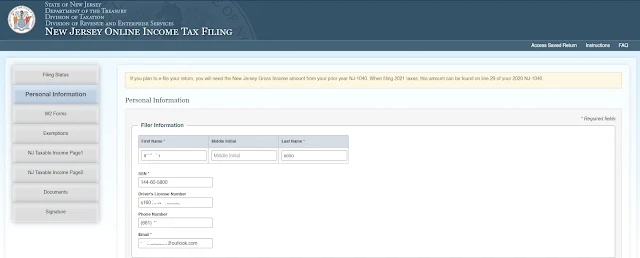

6. Enter the require details by entering the fullz information including the Drivers License Number

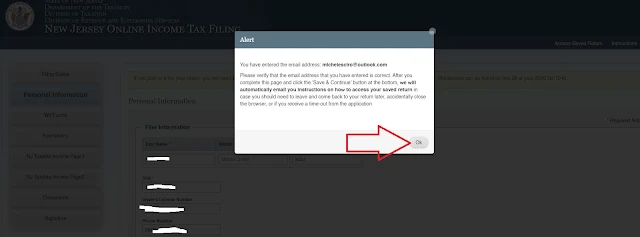

7. When this pops up, click on Ok

8. Enter the address that came with your fullz (Make sure the address is from New Jersey )

9. Tick the Yes option and click Save and Continue

11. First thing first do a background search of the ssn and check for recent or previous company the ssn holder is working or has worked for, Ones you get the company name, just browse eintaxid.com website 12. Then enter the company name you got from the background search in the search bar of eintaxid.com and click on Search

14. Enter the details you got from eintaxid.com and proceed

15.The below amount is calculated as YTD earnings minus pre- tax retirement and pre-tax benefit deductions plus taxable benefits usually found on w-2 form, If you don't find yours or you don't have, fill in the default numbers in the below screenshot

16. Click on the retirement plan and click on Continue

17. Just like I did in step 15, you can do the same if you don't have w-2 form but in the ID section you can enter any state ID (Drivers License Number/ Passport/State Identification/Military Identification)

18. Just scroll down and click on Save and Continue

Tip : You can use this guide "How to edit the 1040 Form" but make sure the amount step 15 will be found the 1040 Form

23. Check the Yes and No boxes like you see in the below screenshot

24.Now enter the Bank Account you would want to receive payment into ( You can use any bank details but if its matches the ssn details, it will make payment and review easier)25.Getting Federal Identification Number can be quite stressful, but some people have this ID number when you do a background check on them. If are a little patient, you can apply for it here or enter random numbers in that section.

26. Click on Validate Return to Continue the process final process

27.Now this answer can BE correctly answered if you can get the salary, interest income, and rental income the fullz owner earned last years in a background check. When you get the amount you will add all. In my caste salary = $140,000 + interest income = $900 + rental income = $620 total = $141,520

Conclusion :

15.The below amount is calculated as YTD earnings minus pre- tax retirement and pre-tax benefit deductions plus taxable benefits usually found on w-2 form, If you don't find yours or you don't have, fill in the default numbers in the below screenshot

24.Now enter the Bank Account you would want to receive payment into ( You can use any bank details but if its matches the ssn details, it will make payment and review easier)

27.Now this answer can BE correctly answered if you can get the salary, interest income, and rental income the fullz owner earned last years in a background check. When you get the amount you will add all. In my caste salary = $140,000 + interest income = $900 + rental income = $620 total = $141,520

This Job can be easy if you have a background checker to answer some hidden questions from the above. I have seen people entering random numbers and information without a proper checker. If you are part of those people, getting paid might be impossible. You can also use free background checkers to get some answers correctly because some shops are selling dead fullz. If you have any questions, feel free to ask in the below section. You can download the 1040 Form Here