Are you finding it challenging to apply the previous article about How To File For TurboTax Refunds In 2023? If the answer is Yes! Follow the new update on the USA Tax Refund method.

If you follow the instructions carefully, the IRS can quickly approve. After many tries and errors, these steps will approve your application.

Requirement

- RDP Or vpn

- DOB as shown on the SSN

- SSN

- Complete address on SSN

- Full name on SSN

- Background checker

- Text Now or Google voice number

- Create a separate email with the SSN details (recommended proton)

Guide to filing USA Tax Refund in 2023

1. Before you begin anything on the internet like this, connect your Rdp or VPN to the SSN state. (If the fullz is from Missouri, join the IP to Missouri).

2. log in to your background checker and do a background search on the SSN; check for the current or previous companies the holder of fullz is working for or recent company ( If you are on a budget, you can use a free checker as fastpeoplesearch.com, but I prefer you go with paid checker )

3. When you get the company's name, go to feinsearch.com or eintaxid.com, paste the company name into the search bar, and click on the search bar.

4. The company's information will show up. We need the EIN; take note of the Employer Identification Number.

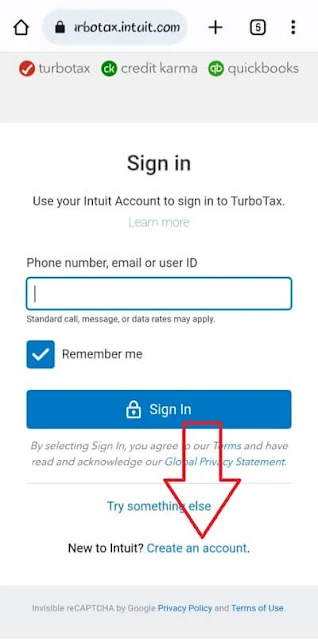

Now, browse the TurboTax portal by copying and pasting this link into your browser https://turbotax.intuit.com/ and click Sign-in.

4. Please enter a password you can remember or keep safe.

5. Click on Let's Go.

6. Select I have a job (received w-2), and I paid rent, respectively.

7. Click on the continue button.

9. Click on File for $0

10. Tab on the No Thanks button

11. Again, click on Let's Go.

12. Please enter first name, last name, date of birth, and zip code as it appears on the fullz

15. Choose, Good

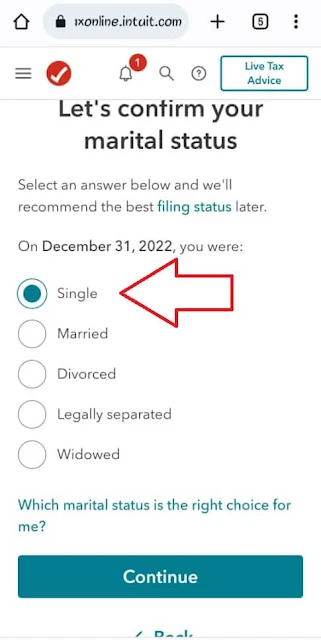

16. When they ask for marital status, choose Single

17. Click on, paid rent.

22. If they want to ask questions about your information, click Let's Go.

24. Choose the answers as you see below

25. Same as below, choose No for all

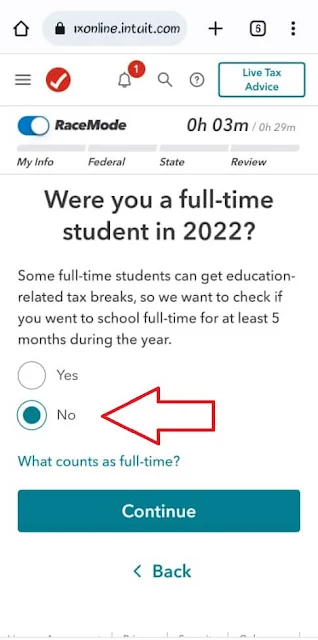

26. Were you a whole student in 2022? Choose No

27. Marital Status Choose Single

28. Check the box for Yes, I paid for everything

29. Choose No

31. Click on Continue

32. Choose the recommended format and click on continue

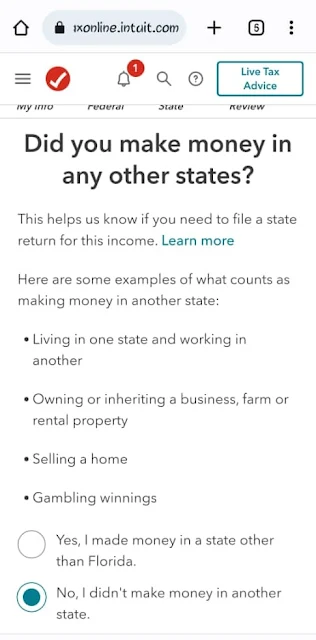

34. Did you make money in other states. Choose No

35. Click on Continue

36. That's the summary of the information you are submitting; if everything is correct, proceed else; edit

38. Click on Not Now

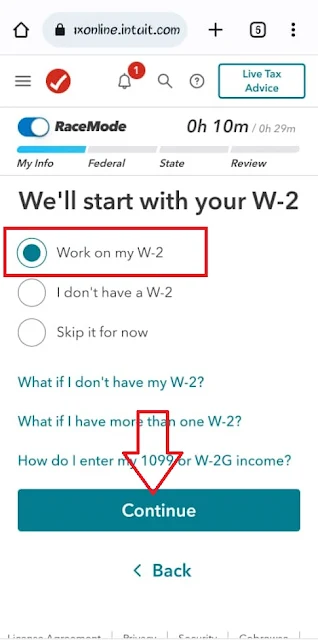

39. Chose the first option that says Work on my W-2 and continues

40. Click on Add my income

41. Enter the EIN number you got from feinsearch.com or eintaxid.com and click on Continue

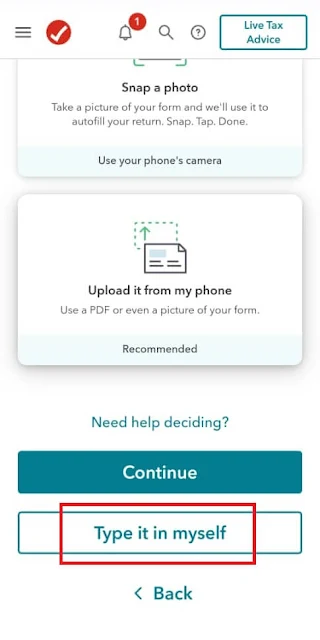

42. Click on Try it in me

43. We are filling in our W-2 form, so enter the fullz information again

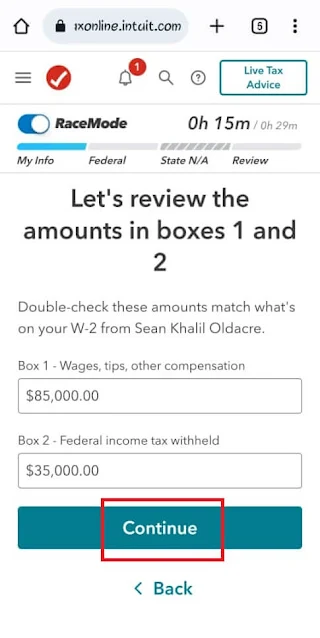

44. In this section, you must enter figures for federal income tax withheld and Wages, tips, and other compensation. Even though you can get a piece of closer information on the Irs calculator, you can enter like this :

- Wages, tips, and other compensation: $80k to $85k

- federal income tax withheld: $30k to $35k

46. Click on Continue

47. You should see the refund you are getting, then click on continue

48. Choose like you see below and click on Continue

49. Click on No

50. Fill in your fullz information again and click on continue

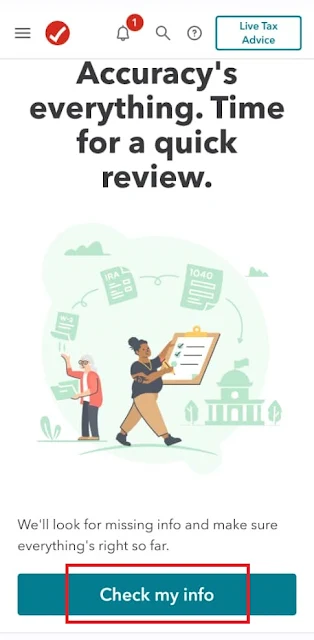

51. Click on Check my Info

52. Click on Continue

53. You will be shown how you are getting, just scroll down and click on continue 54. Click on start state taxes

55. Skip state

56. Click on Check my return

57. When you see your final amount, click continue

58. Click on finish my returns

60. Click on Review your Order

61. Click on Place Order

62. Click on Continue

63. Click on Continue again

64. Click on your Refund Info

65. And click on Get my refund early

66. Choose Direct Deposit and continue.

67. Enter the bank you want to receive the refund name here and Routing and Account number

68. Click on continue

69. Now click sign in and file your returns

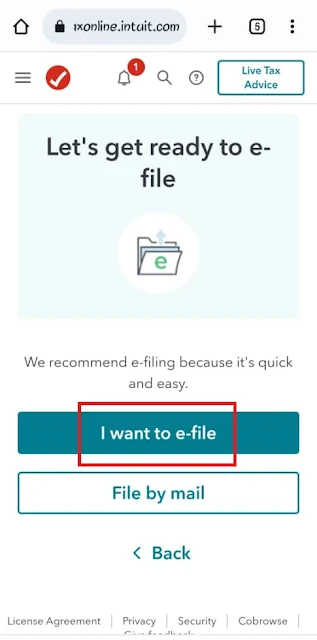

70. Click on I want to e-file

71. Click on Continue

72. Choose I did not file last year and click on continue

73. Click on continue

74. Choose any of the state IDS you have available; I chose State ID

75. Enter the ID information

77. Click on Transmit my return now

78. It will start sending your info to IRS

79. You will need to see success here else something is wrong with the information you submitted

80. Click on Skip; you can choose to rate, but not necessary

81. As it stands, you are done filing, click on continue

82. As you can see, your refund is waiting

84. Login with the username and check after 24 hours if your application has been accepted

Conclusion:

As you can see, this article is very long because we are using the free version to file. I have taken note of something with those fullz shops; most of the shops are selling generated fullz, so you might be getting rejected if your fullz needs to be more accurate or rendered.

Another reason you may get rejected by IRS is your EIN. If you are using client info, ask the whitehead about the company he works for, then go to eintaxid.com to get the EIN, as we explained earlier. If you have any questions, kindly leave them in the comment section.

If you find this helpful article, kindly support my filmmaking channel on YouTube by subscribing to my YouTube channel by clicking here.

.png)

.png)

.png)

.png)

.png)

Thank you so much for dropping this patiently waiting for the next part.

ReplyDeleteYes sir please we are waiting thanks once again.

ReplyDeletewaiting for the next part, thank you big boss

ReplyDeletecan I use cash app to receive funds

ReplyDeleteNo

DeleteHello boss. Abeg I have an issue with the ones I filled. Mine keep getting declined because of a Form 1095-A. Is there a way I can bypass this bro? Thanks.

ReplyDeleteYes. Go to deductions and pick yes to have the form. In policy number put all zeros and in the first box under that put $1 in both boxes next to it. It should be fine afterwards.

DeleteThanks boss shey I fit use bank different from client fullz?

ReplyDelete