Even though TaxSlayer has a friendly platform for filing taxes, you need to learn the procedures, or else you may be for filing taxes the wrong way. In this tutorial, I will show you on filing your Tax on TaxSlayer for free with all the requirements, so follow the step-by-step direction till the end without skipping.

Requirements

- Combine RDP and Socks 5, targeting your Pal or owner's details.

- DOB as shown on the SSN card

- SSN Number

- Complete Address on SSN

- Full Name on SSN card

- Text Now or Google Voice number

- Create a separate email with the SSN details (recommended proton)

- Verified ID.me or whitehead for selfie verification

- W2 Form

- 1099 Form

- EIN or TIN number

- Business Name

Setting Up Your IP Address (make sure it is clean)

1. Connect your sock5 and rdp to the client or owner's IP address. Then head over to whoer.net to check if your IP is clean. You are good to go if you see something like the screenshot below.

2. If your IP looks like this means it's terrible, don't connect. When you visit the taxpayer website, you will be denied, and your cookies will be stored, which can go against you later.

3. You will see this when your IP is not good. Make sure your IP is good before visiting the Taxlayer website

Setting up an Account on TaxSlayer Online

To start filing your TaxSlayer, you must make a new one. Start by entering your personal information, such as your name, address, and contact details. Next, choose a unique username and password to secure your account. Finally, verify your email address to complete the registration process. So let's start with the process. (But if you already have an account, skip this section).

4. Go to TaxSlayer.com and click on the file for free button.

5. Enter the email created with ssn details, username, password and google voice number.

6. Enter the code you received and click on verify.

Navigating the TaxSlayer Online Platform

9. Do the same for this section and click on Continue.

10. Click on Continue with Simply Free

11. Click on Skip

12. Enter the fullz details and click on continue.

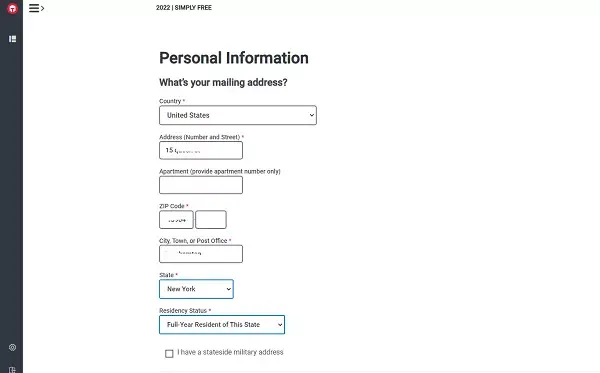

13. Type the address as it appeared on the fullz

14. Click on Skip if your fullz does not fall within any of the below means

15. Choose your filing based on the fullz status and continue

16. Dependent or Qualifying Person (s) Choose Yes

17. Enter random fullz here

18. Select the first option and continue

19. Continue to the next page.

20. If you have ID.me enabled on any 2FA on your fullz, choose Yes else, NO

21. Review all the information and continue.

22. We are done submitting all the needed information about the fullz. Click on Continue.

Reporting Income and Deductions

The next step is to write our various types of payments. If the fullz owner is an employee, we have to enter the information from his W-2 forms received from his employers. Assume your whitehead or fullz owner works freelance or on contract. You must enter income from the 1099 forms. So ensure you have those figures. If you don't have then follow my figures below :

23. Click on Continue.

24. Type the 1099-INT form like see below and click on it (that is, if your client is a contract worker or freelancer)

25. Add W2 Form also to this list if the owner works with an entity

26. You can delete these forms if the fullz owner has different tax documents; else, click Continue.

27. Click Continue again to proceed.

28. Fill out this page with your whitehead business information (in the interest income box 1, enter between 35 to 50 Burks )

29. Continue to the next step

30. Check if the details are correct before you continue

31. You can edit these sections if you have them on your documents or move to the next page

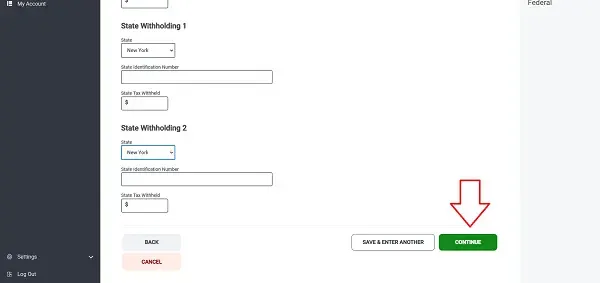

32. Enter your EIN number

33. If you have the W-2 form document, you can upload or enter it usually; I choose it Manually

34. Enter business details here

35. If you don't have any w-2 form, then enter the figures you see in the screenshot

|

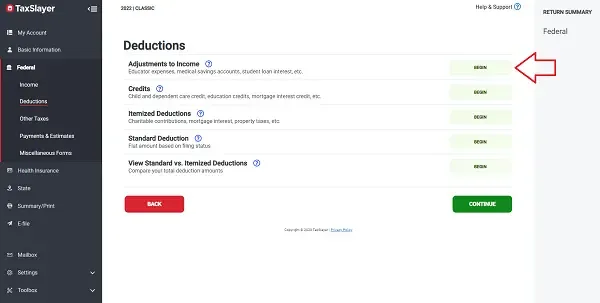

38. Click on Add Deduction Form

39. Click on Edit beside the Credit Option and edit recovery debt credit; enter from $3000 to $5000

41. Click on Begin beside the Health Savings Account form 8889, then choose a family plan.

42. HSA Contribution, Enter from $2K To $5K; duration should be 12 months. Then put 1500 to 2000$ in the HSA Distribution section.

43. Click on Continue

44. Click on Begin beside Standard Deductions

45. Click on Continue

46. Choose No and continue

47. Again, click on Continue

48. You will be directed to this page, just scroll down and continue.

49. Choose No and continue

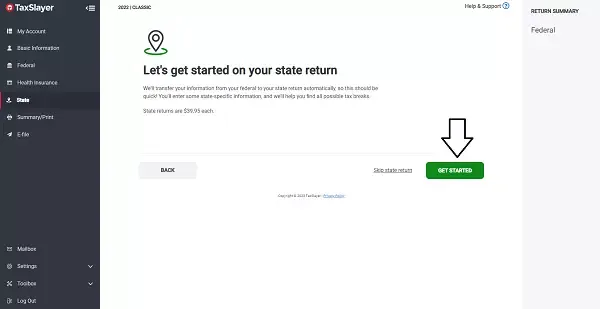

50. Click on get started

51. Choose No contribution for both and continue

52. Click on Yes.

53. Click on Exit Return

54. Click on Continue.

55. Click Continue

56. Are you ready to e-file? Choose yes

57. Click on File & Go

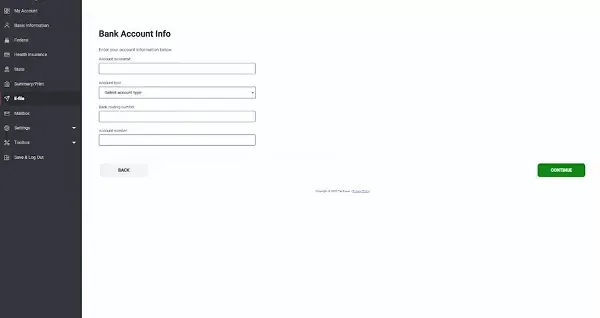

58. Enter the bank details you want to receive payment on and click on Continue, and that's all.

Conclusion:

Following the steps above tutorial, you can file for tax on TaxSlayer. Use the platform's check tools, e-file your return, and enjoy the convenience of a friendly interface. You can comment below if you need any help.

.webp)

.webp)

.webp)

Sir where is the id.me going to be needed , coz through the process I didn’t seeing the id.me getting involved

ReplyDeleteSir thank you so much for this tutorial. But I didn’t see any where the ID.me was required throughout the whole process

ReplyDeleteYes you need idme to get your IRS IP PIN and also your AGI

Deleteid.me would only needed to be used if there was prior year involved in filing correct?

ReplyDeletethat would be the only reason why someone need irs ip pin or AGI?? correct??

How do i go about the employer information/ EIN and co if I don’t have The w2 form

ReplyDeleteI think that’s why we need 1040 or 1099 form cause not all client are employed … I tried putting random EIN numbers on a w2 but it’s got audited

DeleteHello everyone please I can I run the update on phone or laptop please 🙏

ReplyDeleteAside from rdp, which good vpn can I use or kindly recommend where to buy good vpn/rdp. Thank you

ReplyDeleteWhat is a whitehead for the selfie verification?

ReplyDeleteHow do i go about the employer information/ EIN and amount to fill in if I don’t have The w2 form and the client doesn’t work

ReplyDeleteI got a blank irs profile and I need help on how to fix that when I got the letter

ReplyDeleteWhat if client no dy work anymore

ReplyDelete