In this tutorial, I walk you through the ultimate guide to the new Tax refund source for the 2023/2024 tax year. This method is mostly for clients without a job and can forge being a freelancer or someone who is into gambling. If you have a jobless pal, you can follow this guide from the Start to the end, which can earn up to $50K in this year's Tax return.

Requirements for Tax Refund

- Verified ID.me

- Full Name on ID

- Pal's Number

- SSN

- Front and Back of DL or ID

- Create an email in the client's name.

- Any Gambling EIN details

- Current Address

- Good IP RDP or Socks

- Bank in the drop name

$50k Tax Refund Sauce for 2023/2024

1.First, ensure your IP address is clean. You can check this using any IP detector website like Whoer.net.

2. Then head to taxslayer.com and choose the classic options by clicking Start for free.

3. Fill in the client details, including the email you created with the client's name.

4. Enter the code you received on the phone number here and click on verify.

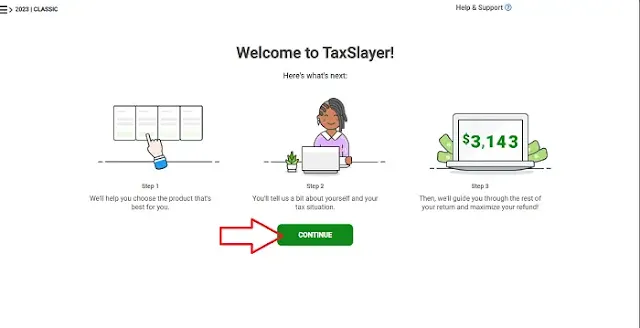

5. Tap on the continue button.

6. Scroll down and click on Remind me later.

7. Up the classic option, click on Continue.

8. Click on Skip

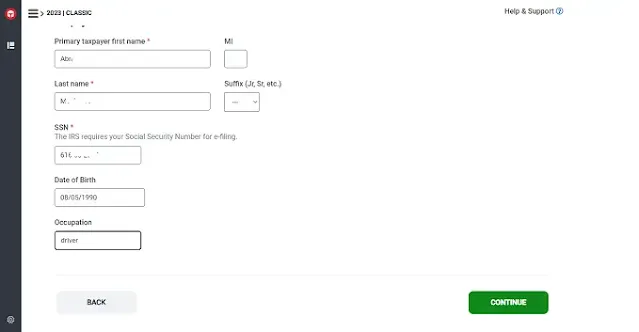

9. Now fill in the client's first & last name, DOB, SSN and occupation.

10. Then fill in the address of the pal. Choose Residency status based on his choice.

11. Don't choose anything here; click on skip.

12. Select single filing.

13. Do you have any dependents or qualified persons to claim on your return? Choose No and continue.

14. Pick No for this section.

15. Go through the information, and if there is no error, click on continue.

16. Click on continue.

17. Do the same for this section.

18. In this section, type and search for the W-2G form and tap on it.

19. Once it appears here, click on continue.

20. Nothing to do here, so again, click on continue.

21. Here is the tricky part: The payer's ID Number is EIN, and the payer's name is the name of the company of the EIN. Then, fill in the address of the company. (You can look for any gambling company in the same state as your client and look for its EIN and the necessary details) You can click here to get details of a company's EIN.

22. Now, we need to enter a reasonable amount of winning information to meet the target amount. Don't enter the same figures below. You can edit them.

23. Scroll down and click on save and enter & enter another to see the amount you are getting.

24. If it doesn't meet the expected amount, click on the three dots to edit them. Note: Don't go above $50k. When done click on continue.

25. Scroll down and click on continue.

26. Choose No

27. Click on Skip state return.

28. Click on continue.

29. Tab on "No Thanks"

30. Choose I do not wish to file my state return.

31. Select Yes; I'm done with my returns and ready to file.

32. Click on File & Go.

33. Click on continue.

34. Select, Direct Deposit and click on Continue.

36. Click on No, Thanks.

37. Do the same for the next three sections.

38. Now enter the Bank information you want to receive your Tax Refund. (Ensure the name matches the SSN info).

39. Click on continue.

40. Fill in this section with either your DL or ID details

41. Agree to the terms & conditions, enter the name, and click continue.

42. This is where you log in to your ID.ME, there are three options here:

- If you choose Yes, I have my 2022 tax return with me. You must log in with your ID.ME to use your last year's IP pin.

- If you go with "No, I didn't file a 2022 tax return, you must enter the PIN manually.

43. I will enter the PIN and click continue based on my chosen option in step 42.

44. Click on Sign and file your return.

45. Click on File Now

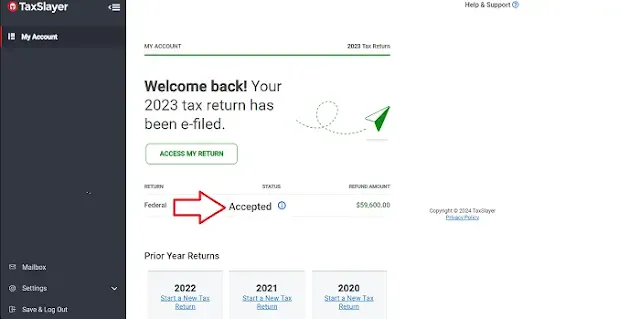

46. Congratulations, your tax return has been e-filed. Click on Go to my account to check your status.

47. My status says Sent and Received.

Conclusion

Once everything goes successfully, you should expect payment after 21 days. Note: There are many different Tax Refund Sauce out there you can use, but ensure you know they're working. I will be updating you guys from time to time. The business pays more than this.

.webp)

.webp)

.webp)

When the sensible one's cash out and you are still on the channel you will see screenshot of payment. I had to delete your comment because they don't make sense and they are misleading. The channel you followed to comment those trash continue following them. Thank you

ReplyDeleteHow does this work if they send a copy of the W-2G to the irs as well

ReplyDelete