One of the best means to deposit a Check into the bank account of a drop address is by using the DDA method. This DDA Check Tutorial covers how to transfer directly to the client bank with just the account and routing number.

Disclaimer

For some reason, I wanted to stop posting about bank jobs due to the demand for bank logs questions, like "Where can I get bank logs to buy ?, Please, can you recommend shops where to purchase bank logs? It is not a wrong question to ask where to buy bank logs, but what comes after you recommend someone to a shop where records are sold is heartbreaking.

Since 2019, I have ended up recommending shops to people. There are a lot of shops out there that claim they sell bank logs. Some of them are fake.

What is a DDA check?

A demand deposit account (DDA) is a check that goes into a checking account without needing advance notice. This check is used for regular exchanges like paying bills, purchasing, etc. DDA checks are safe because funds are withdrawn immediately from the account when offered for payment.What is DDA check charge?

They are fees financial institutions charge for processing a DDA check. The price is assigned to the account holder who wrote the check, and it varies on the bank and the type of account.

Most people get in my Inbox via telegram and ask what the difference between a Demand Deposit Account (DDA) and a Direct Deposit is. Let me explain the difference between the two.

Difference between Demand Deposit Account (DDA) and Direct Deposit.

DDA is a method of withdrawing funds from a bank account at any time without advance notice, Option. At the same time, Direct Deposit is a means of loading funds from a bank account into prepaid cards like Movocash Card, Chime Card, Cashapp, Bluebird card, Greendot card, etc. Now that you know the difference between DDA and Direct Deposit Deposit, let's start with the topic.

Note: The information below is only for educational purposes. I may not be responsible for any damage cost.

Required/ Tools Needed:

- Good Sock5 or any Premium VPN

- Checking Bank logins with email access (Take Note: I Don't sell logs)

- Drop first and last name

- Drop the address (where your DDA check will be sent)

- Drop / Client Phone Number

- Drop / Client Account Number

Step-by-Step Tutorial On How To Do DDA Check

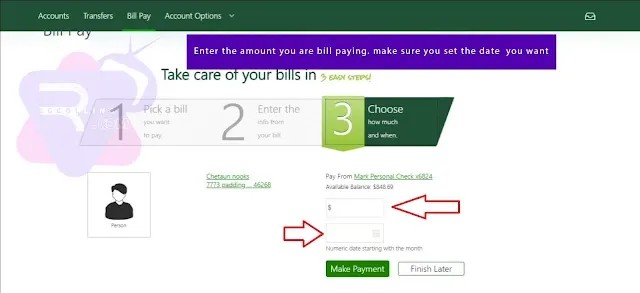

Once you get the above-required information, you can proceed to the main job. Please note that the Demand Deposit Account is similar to Bill Pay, so since I'm not using a screenshot guide, you can use this Step By Step on How to Run Bill Pay.

- To avoid problems logging into any bank logs, connect your IP to the bank log zip code or city IP. Then check on whoer.net to see if your IP is clean.

- Login into your Checking Bank logins with email access

- Click on the Bill Pay Button on the Navigation Bar

- Click on Add Payee

- Choose friends or relatives, or (in some cases, you will see Pay a Person) it depends on the log.

- Three options will pop up depending on the logs you are using. Select the Check Options.

- Then, fill in your information with the client's First and last name.

- Enter the Drop / Client Phone Number.

- Before entering the address, check if the required fill asks for the "Address you use to send payment. If you see that," Enter the bank logs address that came with your bank logs you bought. (If you need to know, search the address on Google.)

- Lastly, enter your Drop / Client Account Number.

- Depending on the bank logs you are using, a code will be sent to the email access that came with the bank logs. Enter the code and continue.

- Once the code is confirmed, the payee (your client) details have been added

- So click on Pay and enter the amount you wish to send (you can only send between $2k to $20k)

- Cross-check if the details you provided are correct

- Then click on Submit.

Conclusion

Simply, we sent a DDA from a hacked bank log with funds on it into the client account directly, unlike Bill Pay, where you will send a check to the client's address. With this method, we send it to the client account. You can use any bank to receive it).

Let me answer this question before you start beating yourself over it: Note that all USA banks have DDA options. Banks like SunTrust, Huntington, Woodforest, etc., can be used. One last thing: Turn off alert notifications when logging into any bank. Go to the settings tab and turn off all notifications. Please, the only help I need in return is for you to subscribe to my YouTube channel by clicking here.

Thanks boss but have questions to ask is the money going into the client bank direct or she will receive the check first and cash it out 2 can I send the money into 2 or 3 people account the same day or different days

ReplyDeleteIt's goes into drop or client bank account then client will only cashout that's why in step 10 you will enter client account number

DeleteYou are good person for sharing this tutorial. Good news is that my card for New Jersey has been shipped. Waiting to cash out something next week. I will buy you data for a wonderful work done. You are a bless to our generation

ReplyDeleteIt took you how long to get response after you

Deletefile the New Jersey?

I applied on Wednesday

DeleteMy first file 7 days my second file is still pending

DeleteBy chance are you offering help to apply nj or Utah or any other state

DeleteThis comment has been removed by a blog administrator.

ReplyDeletewhere can i buy banks logs

ReplyDeleteCome for some

DeleteCan i send a DDA to cash app and Money lion ?

ReplyDeleteDD will be better

DeleteI have studied the Demand deposit many times and it kind of confusing , You said the adress part where payment is going to , The adress of the bank login bought is the address to be filled in , How will the Bank know the bank they are crediting ? if all info they have is just the persons Name , Account number , How will they be able to figure the precise bank they are making payment to out .

ReplyDeleteWill I put the client bank address on it or the log bank address

ReplyDeletePlease can some tell me where i can buy banks logs

ReplyDeleteWhen filling the file do I leave the drop address blank? I mean while filling for the dda

ReplyDeleteCan I do dis DDA into a prepaid Debit cardcard

ReplyDelete