This article will show you how to create a Charles Schwab checking account with a screenshot guide to ease the pressure. If you are looking for a checking bank account with features like:

- No monthly fees

- No minimum balance

- No foreign transaction fees

- Unlimited ATM fee rebates worldwide

- A decent interest rate

- A free brokerage account

Then, consider reading this post to the end because you will learn how to open this checking account for free.

What is Charles Schwab

Charles Schwab is one of the US's largest and most reputable financial institutions, with over $7 trillion in client assets. They offer a range of products and services, including banking, investing, trading, and wealth management.

But one of their best products is their checking account, part of their Schwab Bank High Yield Investor Checking Account. This account is designed for people who want to save money on fees, access their money anywhere in the world, and earn some interest on their balance.

Eligibility for Charles Schwab bank account

Before you can open a Charles Schwab checking account, you must ensure you are eligible. To be eligible, you need to:

- Be a US citizen or resident

- Be at least 18 years old

- Have a valid Social Security number

- Have a US mailing address

- Have a US phone number

If you meet these criteria, you can proceed to the next step. If not, buy US fullz with the following information:

- SSN

- Name

- DOB

- Address information.

- Sock5 or any Good VPN (PIA recommend)

- Create an email matching your SSN details.

- Drivers License Number

- USA Phone Number (Google Voice can be used)

Charles Schwab Checking Account Open-up Method

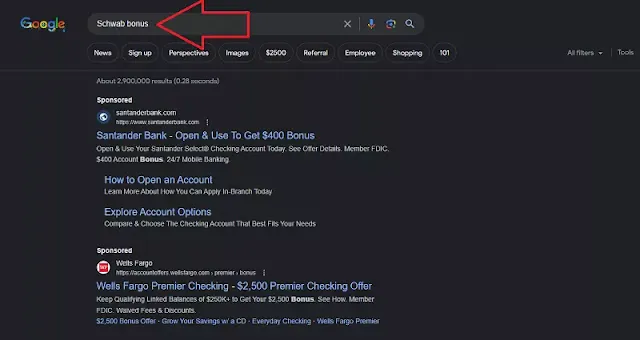

1. Connect your Sock5 or VPN to the profile state, go to Google, and type "Schwab bonus."

2. Scroll till you see "Schwab referral promo awards up to $1000 bonus.

3. When the page opens, click "Schwab Bank Debit Card."

4. Tab on "Open a Checking Account."

5. Choose Individual Checking

6. Click on Get Started.

7. Type the first and last name in this section.

8. Choose Yes for "Is your current home address in the United States, Puerto Rican, or the U.S. Virgin Islands?, Enter your date of birth, SSN, email and Phone Number.

9. Click on the Text me option.

10. Type the code you received on the number you used.

11. Create your login I.D. by entering a username, password and a security question (Keep these details safe; you will need them when you want to log in to your Schwab checking account).

12. Enter the fullz or profile address and choose Yes for "Is your mailing address the same as your current home address?

13. Choose one of these suggested home addresses here and click on Continue.

14. Click on Continue

15. In this section, you can select anything that will fit your checking account.

16. Choose 15 to 30 times per month for how often you use the account and Tax planning and Retirement for reasons for your brokerage account.

17. Select Salary, Wages, or savings as your source of funds for your brokerage account.

18. Choose Employment status, Occupation and for Employment name, google any company and fill in its details as you see in the screenshot below :

19. Go for No, in these sections and continue.

20. Ensure all these are checked and click Continue

21.Select No for these questions including Thinkorswim Trading and Continue.

22. Check if everything is correct on the review page; if there are mistakes, edit and correct them before you.

23. Cross these questions on these pages to the end.

23. Select "Based on the preceding definition, I certify that I am a "Nonprofessional Subscriber."

24. Choose No for "Has the IRS notified you that you are subject to backup withholding"?

25. Allow this page to finish loading

26. On this review page, click on manage account settings.

27. Login with the password you create and enter

28. When you log in, you can check the summary page to see what the account looks like.

Conclusion

That's it. This is how to create a Charles Schwab checking account. However, it will take up to three business days for the bank to approve it, and You must fund the newly created account to start using it entirely. I hope you found this article helpful and informative. If you have any feedback or suggestions, please comment below. I would love to hear from you.

Thank you for reading, and happy banking! 😊

.webp)

.webp)

.webp)

.webp)

.png)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)